Installment Plan for Chicken Farming Equipment in Uganda

Time : 2025-04-27

Are you looking to set up a chicken farming business in Uganda and need some financial help to get started? Well, you’re in luck! An installment plan for chicken farming equipment can be a game-changer for your venture. In this article, we’ll dive into what an installment plan is, how it can benefit your chicken farming business, and how to go about getting one in Uganda. Let’s get down to business!

What is an Installment Plan?

An installment plan, also known as a payment plan, is a way for you to purchase goods or services over time, rather than paying for everything upfront. It’s like breaking your purchase into smaller, more manageable payments. This is especially useful for expensive items like chicken farming equipment, which can be a significant investment for many farmers.

Benefits of an Installment Plan for Chicken Farming Equipment

1. Improved Cash Flow: By spreading out your payments, you don’t have to worry about a large cash outlay at once. This can help you maintain a healthy cash flow for other business expenses.

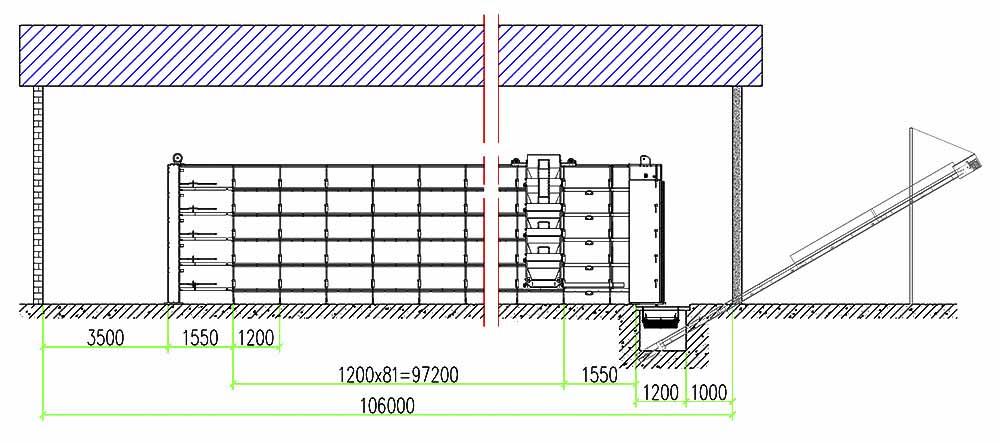

2. Access to High-Quality Equipment: High-quality chicken farming equipment can significantly boost your productivity. With an installment plan, you can afford top-notch equipment without the need for a lump sum.

3. Flexibility: Installment plans offer flexibility in terms of payment terms and the amount of equipment you can purchase. You can tailor the plan to fit your business needs.

4. Easier Approval: Since you’re not expected to pay the full amount upfront, lenders might be more willing to approve your application, especially if you have a solid business plan.

How to Get an Installment Plan for Chicken Farming Equipment in Uganda

1. Research Lenders: Start by researching financial institutions and lenders that offer installment plans. Look for those with good reputations and reasonable interest rates.

2. Business Plan: Prepare a detailed business plan outlining your chicken farming operations, including the types of equipment you need, the expected costs, and your revenue projections. A solid business plan will help you secure the installment plan.

3. Credit Score: Ensure your credit score is in good standing. Lenders will check your credit history to determine your reliability.

4. Apply for the Installment Plan: Fill out the application for the installment plan. Be prepared to provide necessary documents, such as identification, business registration documents, and financial statements.

5. Negotiate Terms: Once you’ve been approved, don’t hesitate to negotiate the terms of the installment plan. Make sure the payments fit your budget and that there are no hidden fees.

6. Monitor Your Payments: Keep track of your payments and make sure you stay on schedule. Missing payments can negatively impact your credit score and may void the installment agreement.

Tips for Choosing the Right Installment Plan

1. Interest Rates: Compare the interest rates of different installment plans. Even a small difference in interest can significantly affect the total cost of your equipment.

2. Payment Terms: Consider the length of the payment term. A longer term will lower your monthly payments but may increase the total interest paid.

3. Collateral Requirements: Some installment plans may require collateral. Make sure you’re comfortable with the terms and have the necessary assets.

4. Flexibility: Choose a plan that offers flexibility in case your business situation changes. Some plans allow for提前付款 without penalties.

Conclusion

Installing an installment plan for chicken farming equipment in Uganda can be a smart move for your business. It allows you to manage your finances better and get the equipment you need to succeed. Remember to do your research, prepare a solid business plan, and negotiate the best terms for your situation.

Now, let’s summarize what we’ve discussed:

– An installment plan allows you to pay for expensive items over time.

– It has several benefits, such as improved cash flow and access to quality equipment.

– To get an installment plan, research lenders, prepare a business plan, and apply.

– Consider interest rates, payment terms, and collateral requirements when choosing a plan.

If you’re serious about chicken farming in Uganda, an installment plan could be the key to making your dreams a reality.